Mastering Lease Accounting: How LEASEE Simplifies Capitalized Costs under PSAK 116

- Yohannes Ekaputra Sananto SE.

- 7 Jul 2025

- 4 menit membaca

The Evolution of Lease Accounting Standards

Lease accounting journal creation has become increasingly complex in business environments both globally and locally in Indonesia. This complexity stems primarily from the implementation of PSAK 73 and its evolution into PSAK 116 as the governing accounting standards.

Under PSAK 73, lessees are no longer required to distinguish between finance-lease contracts (on balance sheet) and operating-lease contracts (off balance sheet). Instead, they must recognize a right-of-use asset and its corresponding lease liability for virtually all lease contracts. The amendments to PSAK 73, now incorporated under PSAK 116 and issued in November 2022, specifically address gaps in how seller-lessees should measure right-of-use assets arising from leaseback transactions.

Many unique terms and covenants in lease agreements—including capitalized costs, residual values, and contingent payments—add significant complexity to lease-related journal entry creation. Among these, capitalized costs are particularly common across various industries and require careful handling.

Understanding Capitalized Costs in Lease Accounting

A capitalized cost represents an expenditure incurred for purchasing a fixed asset that is expected to generate direct economic benefits extending beyond one year or a company's normal operating cycle.

Capitalized costs are typically long-term investments (exceeding one year) in fixed assets expected to produce future cash flows or economic benefits. These costs appear on the balance sheet as assets rather than immediate expenses. The key characteristic of capitalized costs is that they are not deducted from revenues in the period they occur. Instead, the cost is systematically allocated over the asset's useful life through depreciation and amortization.

Categories of Capitalized Costs

Capitalized costs encompass a diverse range of expenditures, each with specific characteristics and treatment requirements:

Tangible Fixed Assets

· Property, Plant & Equipment (PP&E): This category includes land, buildings, machinery, equipment, and other physical assets used in business operations. These assets form the backbone of many organizations' productive capacity and typically represent significant investments with multi-year benefit periods.

· Buildings: Whether purchased or constructed, buildings represent substantial capitalized costs that provide operational space and functionality over extended periods. The capitalization includes not only the purchase price but also costs necessary to bring the building to its intended use.

· Construction Costs: When organizations construct assets rather than purchase them, various associated costs become part of the capitalized amount. These include direct materials, labor costs, transportation expenses, applicable sales taxes, and even interest costs incurred during the construction period.

Intangible Assets

· Trademarks: Legal rights to distinctive marks, symbols, or names that identify products or services represent valuable intangible assets that can be capitalized when acquired or developed.

· Patents: Exclusive rights to inventions or processes that provide competitive advantages and revenue-generating potential over their legal life.

· Software Development: Costs associated with developing software for internal use or for sale can be capitalized when they meet specific criteria related to technological feasibility and future economic benefits.

· Copyrights: Legal protections for original works of authorship that provide exclusive rights to reproduction, distribution, and adaptation.

The Role of Technology in Modern Lease Accounting

LEASEE, an innovative lease accounting software, offers features that help lessees save time and costs while improving accuracy in lease accounting based on PSAK 116 and IFRS 16 standards. The software enhances productivity through its comprehensive range of features designed to handle various lease scenarios, including capitalized costs.

Practical Implementation: Capitalized Costs in LEASEE

Here, we explore how LEASEE effectively manages capitalized costs in lease accounting scenarios.

Step 1: Input the New Contract in LEASEE

In our example scenario, we have a building lease with the following terms:

· Lease term: 3 years

· Annual payment: IDR 100,000,000.00 (paid annually)

· Discount rate: 8%

· Capitalized cost: IDR 10,000,000.00 (paid at lease commencement)

Step 2: Calculate the Contract

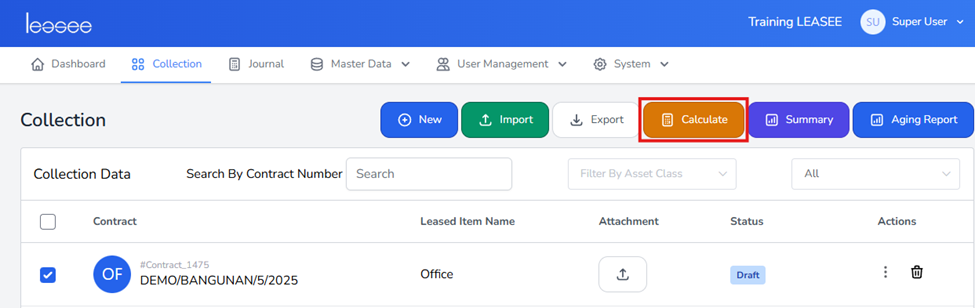

Press "Calculate" for the contract, which changes the status to "Original," indicating the lease is ready for processing.

Step 3: Review the Generated Journal Entries

LEASEE automatically produces the initial journal entries for lease commencement. The system calculates the present value of total lease payments as IDR 256,321,246.05, which is used to record the Right of Use Liability. This amount is then combined with the capitalized cost of IDR 10,000,000.00, resulting in IDR 266,321,246.05 for the Right of Use Asset.

The ROU Liability generates monthly Interest Expense entries (IDR 1,708,808.31 in the first month), while the ROU Asset drives Depreciation Expense calculations (IDR 7,397,812.39 in the first month).

LEASEE generates monthly journal entries throughout the lease term, with lease payment entries occurring in months 12, 24, and 36. In capitalized cost scenarios, the cost is added to the present value of total lease payments, directly impacting the Right of Use Asset calculation.

Conclusion

LEASEE simplifies the complex requirements of PSAK 116 by automating lease accounting calculations and journal entry generation. The software's ability to seamlessly integrate capitalized costs into lease accounting demonstrates its comprehensive approach to modern lease management challenges.

By leveraging LEASEE's capabilities, organizations can ensure accurate compliance with accounting standards while significantly reducing the time and effort required for lease accounting processes. This efficiency allows finance teams to focus on strategic activities rather than manual calculations and administrative tasks.

For more information, visit leasee.id and for a consultation, contact our expert:

Hananto Pandu SE., S.Kom., Ak., CA., CPA., ASEAN CPA. - 0896 3626 1684

Best Regards,

LEASEE Consultant

PT. Sazanka Henig Solusi

Komentar